Rising Interest Rates November 2021

Why are car & equipment finance interest rates rising?

If you have applied for a car or equipment loan in the last few weeks you may have been a little shocked by the talk of interest rates going up.

Rates are now higher not because the banks and finance companies want to charge more, it is because their cost of funds is on the rise.

We have enjoyed a downward trend with rates for (what seems like) a long time. However the honeymoon period of these extremely low rates is over. Rates have gone up. And will continue to rise.

But why?

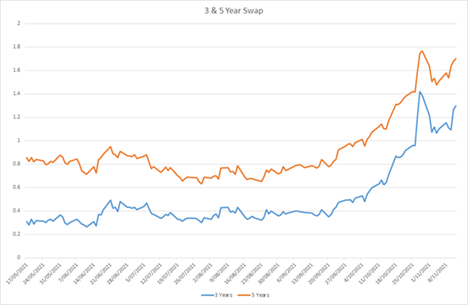

When many people think about interest rates they often don't realise that home loan rates and car/equipment loan rates are different. Primarily asset finance deals represent a higher risk to lenders and therefore attract a rate reflecting this risk. The other significant difference is that asset finance loans are based on a fixed rate for the loan term whereas mortgage loans are often variable (which are still relatively low). Note however that because rates are anticipated to rise in coming years the future fixed rates need to be increased to allow for this predicted rise. The graph in the header of this blog post shows that 3 and 5 year swap rate.

If you would like to learn more or need a quote on car/equipment finance please contact Andrew on 1300 55 77 50 or use this form to email